Welcome to another edition of SOURCE, a publication that shines the spotlight on funds and their managers. In this issue we focus on Carmignac Portfolio EM Debt fund (classified Article 9 according to the SFDR1), managed by AAA rated Joseph Mouawad2; and how its unique blend of socially responsible investment strategy and proprietary quantitative scoring system has generated a healthy double-digit cumulated return since launch3 despite an extraordinarily tough year for emerging markets.

Carmignac Portfolio EM Debt fund through the eyes of its Fund Manager

Although the Carmignac Portfolio EM Debt fund was created more than three years ago4 as part of the ‘Carmignac Lab’, an in-house elite incubator for innovative strategies, the investment manager only opened the fund to external investment at the end of 2020. The idea was to build up a ‘tried and tested’ three-year track record before starting to market the fund to investors, explains Joseph Mouawad.

‘This is a strategy that was originally run in our EM multi-asset fund Carmignac Portfolio Emerging Patrimoine. So initially it wasn’t a standalone fund, but given the successful performance of this strategy, we decided to launch it as an autonomous fund in 2017’ said Mouawad. ‘This is a portfolio that really offers fixed income investors an attractive alternative right now. Interest rates are extremely low in the developed world – they stand well below inflation rates and so investors find themselves trapped in an extremely low return environment now. This is creating a very challenging context for fixed income investors on a global scale. Carmignac Portfolio EM Debt offers a strong alternative to people who want to escape the financial repression in developed countries, by allowing investors to capture EM bond market opportunities with attractive risk reward profiles.’

Mouawad manages the strategy with the assistance of James Blanning, EM sovereign debt analyst at Carmignac. Together, they form the EM expertise on the fixed income team at the Paris-based investment manager.

'This is a portfolio that really offers fixed income investors an attractive alternative right now'

joseph Mouawad

‘We work very closely together. While each of us is a lead on a specific country in terms of coverage, we both follow all the countries we’re invested in. Especially in terms of risk management and to adapt the portfolio construction of the fund,’ Mouawad explains their complementary roles. Blanning’s focus tends to be on the more difficult to access frontier markets, which require in-depth knowledge of market dynamics and economies as well as local politics.

‘Investing in frontier markets is a powerful way to make an impactful investment in terms of ESG as they often start from a very low base. Our investments in Ukraine illustrate this well: following the invasion of Crimea and a deep economic crisis, the IMF started a program that’s helping to reform the country’s institutions by improving their quality and combating corruption,’ said Blanning.

‘In a more day-to-day role, I keep track of the rest of EM countries, and follow the fund's risk exposure to make sure that we remain in line with our various constraints, while contributing as well with new ideas for the portfolio construction. Joseph and I are constantly exchanging information about what is happening in EMs and more broadly what could affect our investments. Communication is especially important given the breadth of our investment universe where, for instance, there can be several central bank decisions in any given day.’

The two men have formed a strong team in the last few years. This is reflected in the strategy’s positioning in the top decile of returns compared with peer strategies over three years5.

‘Both of us have a quantitative background and this has allowed us to develop various models and systems that are required for managing a strategy as complex as Carmignac Portfolio EM Debt. We have also developed various proprietary quantitative methods including systematic signals and our proprietary ESG scoring system,’ said Mouawad.

‘The sweet spot really lies closely between our macro views and their micro views’

joseph Mouawad

The winning formula to the strategy’s success lies in the deep fixed income expertise of Carmignac as an investment house, that the EM Debt team can plug into. At Carmignac, the positive performance of individual strategies is a team effort.

‘We sit within a wider fixed income team and work very closely with various partners across the firm: Rose Ouahba is the head of the fixed income team, and her input is very important for all of our top-down decisions. Our central bank watcher, Michael Michaelides, is another key person who wields influence. We also work very closely with two specific teams within Carmignac: the first is the credit team run by Citywire AAA-rated Pierre Verlé6. Their expertise is particularly strong in the micro part of the economy and given that Carmignac Portfolio EM Debt fund typically has 10% to 20% invested in corporate credit, their expertise is absolutely crucial in the selection of the names for portfolio construction. The sweet spot really lies closely between our macro views and their micro views in terms of selecting the securities that go in the corporate portfolio part of the fund,’ Mouawad explains.

‘The EM equity team run by AA-rated Xavier Hovasse7 is equally important and our close interactions influence all investment decisions. Hovasse’s team and our team have a vested interest in sovereign risk and in macro developments. So, we’re both very eager to make the right risk assessment on the various countries.’

A viable alternative in a difficult fixed income space is the latest offering from French investment house Carmignac – in the form of its Carmignac Portfolio EM Debt fund.

‘We’re in an environment that is very financially repressed. Interest rates stand at close to zero percent – or even in negative territory when we look at Europe, the UK, the US and Australia in real rates,’ said Joseph Mouawad, Carmignac Portfolio EM Debt’s manager. ‘But ultra-low interest rates alone are not a new phenomenon anymore, what’s much more concerning is that we’re now in a cycle of low interest rates coupled with rising inflation. This combination can be detrimental for fixed income investors as the interest rates you stand to gain from are now deeply negative. That means you’re practically guaranteed a loss of purchasing power by investing in the fixed income space in developed markets. Indeed, EMs are the only part of the fixed income universe that offers investors yields above inflation. I’m speaking about positive real interest rates, while providing attractive assets.’

Standing out

Carmignac’s pragmatic view on the fixed income space has garnered impressive returns for the fund – both since its inception on 31 July 2017 and on a three-year annualised basis – gaining a healthy 13.25% versus +3.73% for its reference indicator8 (as of 30 September) with a volatility in the high-single-digit range5.

‘The fund compares very favourably, relative to its category average. If we look over one, two or three years, or even since inception, the fund ranks in the first decile in terms of returns and sharpe ratio5’

joseph Mouawad

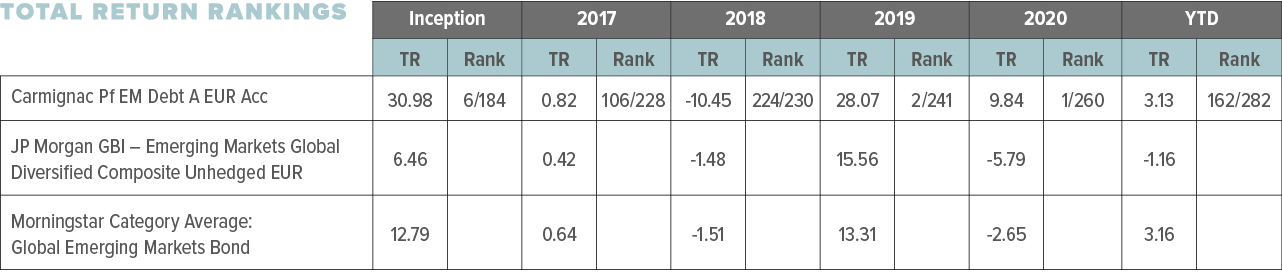

‘The fund compares very favourably, relative to its category average. If we look over one, two or three years, or even since inception, the fund ranks in the first decile in terms of returns and Sharpe ratio5,’ said Mouawad. ‘This is a direct consequence of our investment process and of the strong team that supports the various components of the fund. Even since the beginning of 2021, despite a relatively volatile and difficult year for EMs, the fund has achieved a positive return9, while the reference indicator8 and the majority of our peers have remained in a negative territory.’

Carmignac Portfolio EM Debt is a socially responsible investment fixed income Ucits fund, that implements local debt, external debt and currency strategies across EMs while integrating ESG criteria into the decision-making process. Managed by Mouawad, with the assistance of James Blanning and the wider fixed income team, the conviction-based strategy relies on a combination of systematic signals and discretionary decision-making.

‘We tend to have a relatively concentrated portfolio focused on high conviction investments and we use two filters to help us navigate this universe: the first filter is a systematic signal that marries valuation and macro. So, the model helps us to narrow down our investment universe by differentiating between cheap and expensive assets,’ said Mouawad.

‘We believe that EM debt is a must in any fixed income portfolio today’

joseph Mouawad

‘As a next step, we implement our ESG scoring system, which acts simultaneously as a second filter and a risk management tool because it allows us to focus on the dynamics of countries that reflect strong or improving ESG-related characteristics regarding their exposure to environment, social and governance pillars. In the EM space, we can’t purely rely on models or systematic signals. We also need a fair bit of discretionary work that involves travelling, talking to officials, economists and political analysts to really understand the various dynamics of a potential investment candidate.’

The fund’s flexible and opportunistic style enables the strategy to follow a largely unconstrained, conviction-driven allocation philosophy seeking to uncover multiple opportunities in EMs across all conditions. Mouawad believes it’s this flexibility alongside the fund’s socially responsible approach combined with its systematic and discretionary methodology, that makes Carmignac Portfolio EM Debt stand out from its peers.

‘Our strategy has a very flexible investment process, that allows us to hedge against risks but equally to take exposure, when the risk reward warrants it. This flexibility also extends from asset classes to geography,’ said Mouawad.

‘So, if we believe that a certain geographical area or a certain set of countries are not attractive investments, our flexible investment mandate allows us to have zero exposure, because we’re not managing a purely benchmarked approach that requires a certain allocation to each country at all times. This flexibility in combination with our systematic and discretionary approach, alongside our ESG impact model makes this fund unique.’

Fixed income necessity

Mouawad’s experience in investing in EMs since joining Carmignac in 2015 has also served as a natural hedge against inflation during turbulent market conditions in 2020 and 2021.

‘EMs today basically produce the majority of commodities and the goods that the rest of the world consumes. Consequently, they act as a natural hedge against the rise of these prices because they own the basic materials and the commodities. In other words, they are a natural hedge against rising inflation,’ said Mouawad. ‘We believe that EM debt is a must in any fixed income portfolio today, because it is the only guarantee that you won’t incur a loss of purchasing power over time.’

Mouawad and the Carmignac team take risk mitigation seriously and carefully monitor the contribution of each asset class including FX, sovereign credit and corporate credit to the overall volatility of the portfolio. The fund’s ESG filter is another risk management tool because it scans for long-term political risks across countries.

‘On top of all that, we have prospectus limits: hurdles on duration, leverage, volatility and in addition we also have internal limits as an investment manager that pertain to restrictions on concentration, limits on liquidity, rating and so on,’ said Mouawad.

At the beginning of 2021, the fund benefited from allocations to investment grade EMs including China, Russia, Indonesia, Korea and Chile, which delivered positive real interest rates.

‘We’re really focusing on these quality sovereign credits that offer very decent inflation-adjusted yields,’ said Mouawad. ‘Essentially we’re operating in the investment grade space here and we’re being paid well above inflation. So, this has been our strategy in 2021 and it has worked well with the Chinese renminbi being one of the strongest currencies, as well as the Russian ruble.’

Looking forward, Mouawad and the team believe emerging markets in general will remain well supported and continue to benefit from the low interest rate environment.

‘We’re still in a reflationary environment. As we continue to exit the pandemic – and given the very large stimulus programmes in the West and the very loose current fiscal and monetary policy mix – we’re going to be in an environment where inflation keeps rising,’ said Mouawad. ‘Commodity prices therefore remain well supported as growth slowly reaccelerates when we exit the pandemic.’

Joseph Mouawad has been on an astonishing run since the beginning of 2019, returning 45.1% to investors, compared with 7.6% for the reference indicator and 13.8% for the average fund in the Morningstar category. Much of these strong returns have been delivered since the coronavirus crash. From the end of March 2020 the fund has leapt 34.2%, more than double the 15.3% gain made by the category average and more than four times the indicator‘s 7.4% gain.

SOURCE: Morningstar/Carmignac as at 30.09.2021. Performance is based on total return in EUR calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on the Global Emerging Markets Bond Morningstar category.

SOURCE: Morningstar/Carmignac as at 30.09.2021. Performance is based on total return in EUR calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on the Global Emerging Markets Bond Morningstar category.

Since inception, Carmignac Portfolio EM Debt has delivered some of the strongest returns in the global emerging market debt peer group, with the gains of 31% nearly five times the reference index‘s 6.5% gain and nearly three times more than the Morningstar category average; the fund‘s performance places it 6th of 184 funds over that time frame in the peer group, well within the top decile. Lead manager Joseph Mouawad has delivered class leading returns in two of his three full calendar years at the helm; in both 2019 and 2020 he topped the peer group for total returns. This was most impressive in 2020, when he achieved positive returns of 9.8%, while the index fell 5.8% and the average manager gave up 2.7%. It may be easy to attribute this success to the uprise in ESG funds over the course of the pandemic, but Mouawad‘s fund is an outlier. The fund is one of seven funds classified as SFDR Article 91 – funds that explicitly have a sustainable investment objective – however, it has outperformed all of those peers since launch. Mouawad holds a Citywire AAA Fund Manager Rating for risk-adjusted outperformance2.

SOURCE: Morningstar/Carmignac as at 30.09.2021. Performance is based on total return in EUR calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Peer group composed of the oldest share classes of all funds within the Global Emerging Markets Bond Morningstar category (including open-ended funds and ETFs)

DISCLAIMER: Performance of the A EUR Acc share class. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations.1. Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.2. Source and copyright: Citywire. Joseph Mouawad is AAA-rated by Citywire for his rolling three-year risk-adjusted performance across all funds he is managing to 30 September 2021.

ESG has become a buzzword in recent years, but Carmignac’s history of ethical investing began decades ago.

‘At Carmignac, we’ve been investing responsibly since 1989, when the company was founded. So, it’s something that we have embraced from the start and that we’re very proud of as an investment house,’ says Joseph Mouawad, the Carmignac Portfolio EM Debt fund’s portfolio manager. ‘Today, over 85% of our assets under management meet either Article 8 or Article 9 of the Sustainable Finance Disclosure Regulation (SFDR)1. That’s encouragingly high.’

The European Commission developed its SFDR classification system in a bid to standardise ESG terminology and reporting, and to help eliminate the practice of ‘greenwashing’. The charter aims to ensure that investors in the EU have the relevant level of transparency and disclosures to make investment decisions based on more than a socially responsible marketing spin. Today, there are three classifications of investment products within sustainable investing, of which Articles 8 and 9 are the most demanding. To be classified into one of these two Articles, funds must demonstrate that they are actively promoting environmental and social characteristics or that they invest in companies or countries that demonstrate a positive sustainable outcome as part of their business models.

‘Within Carmignac Portfolio EM Debt, our ESG approach is impact-oriented and focused on the dynamics at play in the various sovereigns, as opposed to adopting a static-based ESG approach,’ says Mouawad. ‘At Carmignac we don’t stop monitoring ESG factors once the investment decision is made: the management team reviews their investment’s ESG features through the tracking of key metrics on an ongoing basis.’

‘WE DON’T STOP MONITORING ESG FACTORS ONCE THE INVESTMENT DECISION IS MADE: THE MANAGEMENT TEAM TRACKS KEY METRICS ON AN ONGOING BASIS’

joseph Mouawad

To this end, Mouawad and the team have developed a proprietary ESG scoring system. Each country is allocated a score from one, which is the least socially responsible, to five, with the number three being neutral. Each of the three components – the E, S and G – is weighted equally.

‘Some elements that qualify as environmental also have important social and governance components and vice versa. So, in reality, they’re all intertwined. Therefore, they’re equally weighted, although each element also has its own importance,’ Mouawad says.

Within the three categories, there are static and dynamic subcomponents, which contribute to the overall score. This score is aggregated as the weighted average of the country score and the exposure of the underlying positions.

‘With our scoring system, we’ve tried to develop a quantitative approach that relies on data from publicly available sources to focus on all the relevant dimensions of ESG. So, for example, we focus on change in terms of CO2 emissions per capita or the actual change in terms of renewable energy percentage in the mix of total energy supply. The same principles apply to the social aspects: here, we might look at change of GDP per capita and change in terms of life expectancy, rather than just focusing on absolute levels,’ says Mouawad.

‘This is a scoring system that we compute in a perfectly transparent way. It’s published on our website and it’s publicly available data – anybody could download and adopt it if they wished to.’

Carmignac’s socially responsible investment methodology goes against the grain of industry practice. Other funds often tend to assign the highest ESG scores to most developed countries.

‘We believe that our scoring system allows us to have an impact in our financing when considering sovereigns,’ says Mouawad. ‘It’s a system that has a low correlation with credit ratings because we are trying to capture a different dimension, rather than trying to measure the same type of risk under a different name, which is what you tend to find in the industry. We care about making an impact with our financing.’

The fund aims to generate positive risk-adjusted returns in the EM bond space over an investment period of three years while making a positive impact on society and the environment at the same time10. So far, this has paid off handsomely, illustrated in the double-digit annualised returns of 13.25%, versus 3.73% for its reference indicator8, with a volatility in the high-single-digit range and a healthy Sharpe ratio above 1 over three years11.

‘WE WANT TO FOCUS ON COUNTRIES THAT HAVE A LOWER POLITICAL RISK AND COUNTRIES THAT ARE DOING WELL IN TERMS OF SOCIAL PROGRESS, BY IMPROVING THE LIVES OF THEIR POPULATIONS’

joseph Mouawad

Carmignac’s fixed income team believe that a thorough assessment of governance and social factors in EMs isn’t just a crucial element in contributing to positive returns but is also the key to risk mitigation in developing countries.

‘When you’re investing in emerging markets, it is very difficult to forecast political events – whether we’re referring to revolutions or the rise of a particular populist. It’s very important to have a system in place to make sure you’re invested in countries that have a lower risk in that sense, even if it’s extremely difficult to forecast some of these crises,’ says Mouawad.

‘We want to focus on countries that have a lower political risk and countries that are doing well in terms of social progress, by improving the lives of their populations. For example, increasing median wages and life expectancy, investing in education, reducing inequality and at the same time improving governance and transparency.’

By using social responsibility criteria as a robust risk management tool, the likelihood of making allocations to unstable countries and regions can diminish substantially.

‘We try to assess if governments are not attempting to make improvements at the expense of sustainability and future generations. If a country focuses its efforts on sustainable development, we expect the likelihood of having a political conflict to be lower,’ says Mouawad. ‘This is why for us, it has always been important to integrate this thinking in our investment process and we’ve done that also from a risk management perspective, rather than just to get a label or to be called ESG compliant.

Hence social responsibility has been at the core of the strategy from the very start.

‘When we first launched the fund, it was crucial for us to have a tight risk assessment of the social and the governance material factors within emerging markets. As the years went by, we developed and fine-honed this approach more and more to integrate environmental aspects as well on top of social and governance factors,’ says Mouawad.

1. Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. For more information, please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

2. Source and copyright: Citywire. Joseph Mouawad is AAA-rated by Citywire for his rolling three-year risk-adjusted performance across all funds the manager is managing to 30 September 2021.

3. Source: Carmignac, 30/09/2021. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations.

4. Date of first NAV: 31/07/2017.

5. Source: Carmignac, Morningstar, 30/09/2021. Morningstar category: Global Emerging Markets Bond. Performance of the A EUR Acc share class ISIN code: LU1623763221. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations.

6. Source and copyright: Citywire. Pierre Verlé is AAA-rated by Citywire for his rolling three-year risk-adjusted performance across all funds he is managing to 30 September 2021.

7. Source and Copyright: Citywire. Xavier Hovasse is AA-rated by Citywire for his rolling three-year risk-adjusted performance across all funds he is managing to 30 September 2021.

8. Reference indicator: JP Morgan GBI – Emerging Markets Global Diversified Composite Unhedged EUR index.

9. Source: Carmignac, 30/09/2021.

10. The Fund aims to generate sustainable, positive risk-adjusted returns, over a minimum recommended investment period of three years, as well as outperform its reference indicator. It also seeks to contribute positively to society and the environment.

11. Source: Carmignac, 30/09/2021. Performance of the A EUR Acc share class. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations.

MAIN RISKS OF THE FUNDS

Carmignac Portfolio EM Debt

EMERGING MARKETS: Operating conditions and supervision in “emerging” markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest. INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates. CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments. CREDIT: Credit risk is the risk that the issuer may default.

Carmignac Portfolio EMerging patrimoine

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization. INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates. Credit: Credit risk is the risk that the issuer may default. Emerging markets: Operating conditions and supervision in “emerging” markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

The funds present a risk of loss of capital.

*For the A EUR Acc share classes. SRRI from the KIID (Key Investor Information Document): scale from 1 (lowest risk) to 7 (highest risk); category-1 risk does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either ‘Article 8’ funds, which promote environmental” and social characteristics, ‘Article 9’ funds, which make sustainable investments with measurable objectives, or ‘Article 6’ funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

CITYWIRE INVESTMENT WARNING

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk.

Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector.

Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings:

The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk.

Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

TERMS OF SERVICE

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 3 Spring Mews, London SE11 5AN, and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise.2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.